The DeliveryX Top1000 Europe 2023 report, which is available to pre-register for now, has highlighted the importance of home delivery for consumers across Europe.

Nearly 30% of European consumers shop online at least once a week, this rises to over 40% when considering their monthly shopping habits. For the not-insignificant number of shoppers, delivery is very important and, in fact, is a driving factor.

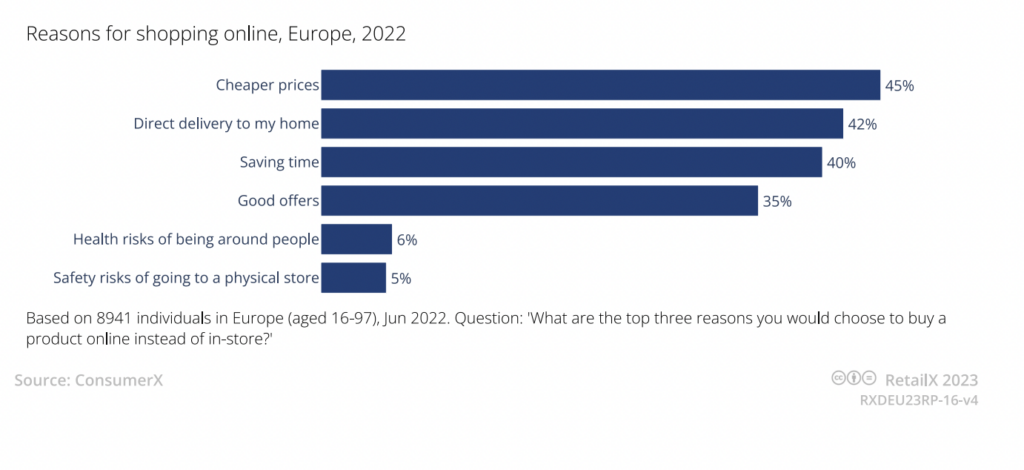

On average 42% of ecommerce shoppers in Europe do so due to direct delivery to their home. Getting products to their door is also a key driver for UK shoppers with nearly 47% citing home delivery as a reason to shop online. This is higher than their European neighbours, as in France home delivery is only enticing to 40% of shoppers online, while in Germany it is 43%.

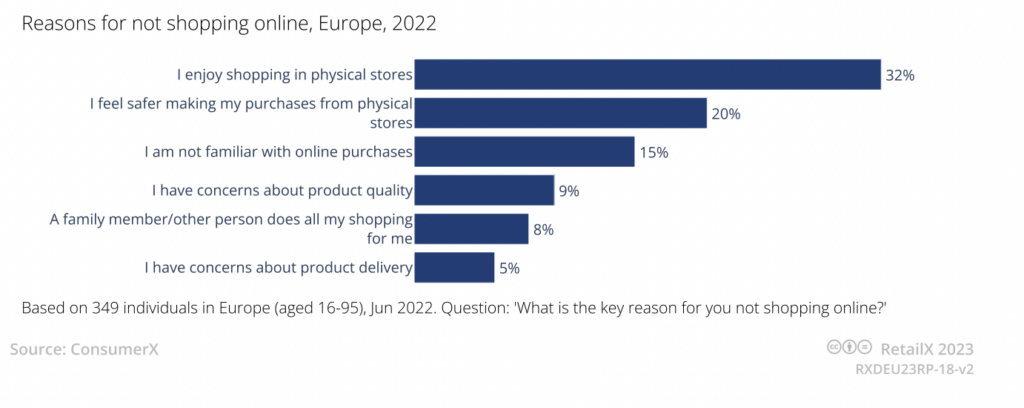

But for some, home delivery can be a cause of worry, and even a reason not to shop online. A small percentage (6%) cite concerns over delivery as being the reason they do not shop online. There are still a number of European shoppers that simply enjoy the physical act of shopping (35%) and those who feel secure when purchasing from a bricks-and-mortar store (22%).

The need for speed

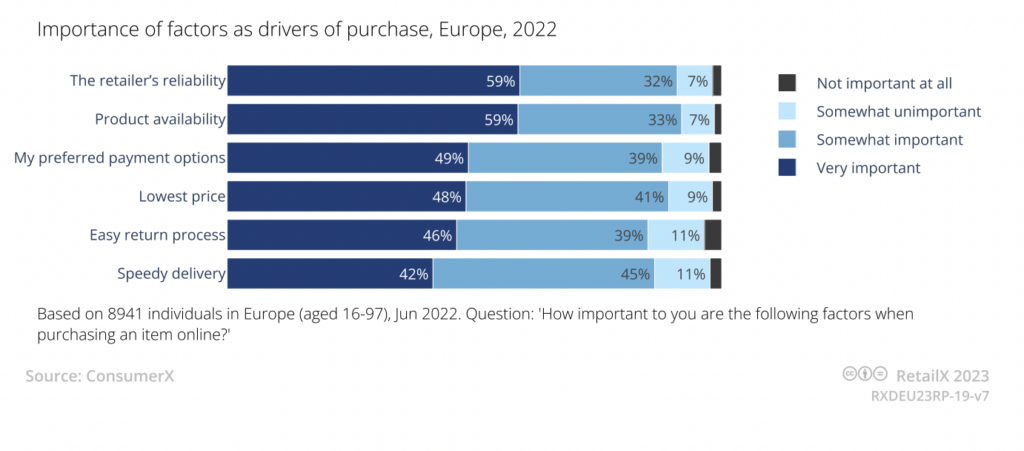

While there is a growing trend of fast delivery across Europe – Uber recently told a conference that same-day is the new next-day – for consumers speed of delivery still remains behind other key drivers for shopping online.

Nearly 42% of EU consumers see speedy delivery as an important factor when purchasing online, however this is overshadowed by the retailer’s reliability, which tops the list at 59%. Product availability, price, payment options and an easy returns policy all sit higher in consumer’s priorities than fast delivery.

Despite Uber’s comments, it seems that next-day delivery currently remains the favoured option for European consumers. When asked to consider purchases in the past 12 months how important next-day was, a third said it was for the majority of their purchases.

Furthermore, over half (56%) of EU’s online consumers are willing to pay extra for next-day delivery, 54% are willing to fork out to get products on the same-day.

Another option a growing number of consumers across Europe are willing to pay extra for is sustainable delivery. There have been moves by consumers and retailers alike to move towards greener and more circular offerings. To this end, over 46% of consumers not only favour sustainable delivery methods, but are willing to pay extra for it.

This is interesting considering the recent introduction of charges for the reverse logistics of returns, which is also covered in the report. Many in the industry were concerned that such returns charges would put deter potential customers, especially when ease of returns remains such an important factor to many of them.

The question therefore needs to be asked – if shoppers are willing to pay for green delivery, why aren’t they for green returns?

This feature appears in the DeliveryX Europe Top1000 2023 report, which is coming soon, pre-register now to discover:

- 32 pages of concise data-driven insight, that delves into how leading retailers are succeeding in the supply chain, logistics and delivery/returns experience

- 15 company profile case studies including KPI comparisons. Includes: M&S, H&M, Aldi, Albert Heijn, Lego, Asda and Sephora