As part of the recently published Global Elite Top1000 2023 report, RetailX measured how retailers handle order management and orchestration through the sales cycle, all actions that affect profit per order…

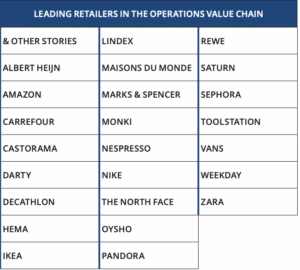

Leading retailers in the operations value chain are predominantly multichannel retailers. They have successfully integrated their bricks-and-mortar stores and digital channels to enhance the customer experience for all customers, whether they shop via one channel or all of them. They have changed how customers receive their online purchases enabling them to reserve or buy products online and collect them from a physical store either that day or at a later point.

Some, like DIY and building trade retailer Toolstation enable customers to pick up their order just five minutes after it has been placed online – as long as the chosen store is open and the item is in stock. Using stores to fulfil orders either for collection in store or for home delivery requires a retailer to know the exact level of stock in every store or to put in place a level below which online orders cannot be guaranteed. In the early days of pickup in store it was not unusual for store staff to be hunting for a product that the system says is the last one available but it is not on the shelf as expected in the store.

Marks & Spencer and Zara both incorporate RFID tags in their garments to track them through the supply chain and allow stock checks to be handled very quickly in a semi-automated way.

The one pureplay retailer on the list of leaders in this value chain is Amazon. The US behemoth is known for its operational efficiencies going so far as to acquire robotics company Kiva Systems in 2012 in a bid to increase efficiencies in its distribution centres.

Work by the carrier industry to reduce failed first-time deliveries and customer self-service techniques such as AI-powered chatbots all further reduce costs – and waste – for the industry. Every cost saving through greater efficiency in moving product from goods in through the distribution centre to delivery to store for the customer to collect or delivery to their home results in a greater profit per order. As does increasing efficiency is picking and packing to goods out and the returns journey should a customer no longer want the item they’ve ordered.

For brands, the switch to direct-to-consumer rather than previous purely operating a wholesale retail model has created a closeness with the customer as well major changes in their logistics as they’ve moved from shipping pallets to individual items. For instance, in 2011, 84% of Nike’s sales were to wholesale customers. In 2021, this had dropped to 61%, with direct to consumer sales accounting for the remaining 39% – and this figure is rising. By 2025, the brand aims for 60% of its sales to come from its own stores and digital channels with the latter accounting for 50%.

Not only does the direct-to-consumer model give brands greater control and brings them closer to the consumer enabling greater direct interaction, it also increases profits since it cuts out the middle man of the wholesale partner.

The RetailX research team looked closer at the operations value chain and the ways in which business KPIs manifest in how retailers fulfil customer orders, allow unwanted goods to be returned and use their own stores to offer convenient collection.

HOW RETAILERS OFFER OMNICHANNEL CONVENIENCE

Seamless operations between bricks-and-mortar stores and digital channels enable retailers to offer a range of services to customers along with greater convenience, even in geographies where ecommerce is still maturing. The larger a retailer’s store estate, the easier it is for customers to visit, view products, collect online purchases and return items.

The average number of stores operated either as owned or franchised among the retailers in the Global Elite 1000 is 520. However, among omnichannel the retailers which have their headquarters in Africa there are a small number of retailers with large store estates. The average number of stores among this group of 49 retailers is 1,320. The median value is a lot lower at 13 emphasising the difference between retailers and how a large store estate is only one aspect of a retailer joining the Global Elite.

This dichotomy between store estate sizes is echoed in many regions. In North East Asia, the average number of stores is 590 and the median is just above 30. The picture is similar in the Middle East which has a number of large omnichannel retailers as well as ones with fewer stores. Of the 84 retailers in the Middle East assessed by the RetailX researchers, the average store estate size is 909. The median is 18. Retailers here have been expanding rapidly, with Jordan, Oman and Bahrain among five countries with the largest increase in store estate sizes in the past year.

Supermarkets have the largest store estates – averaging 10,000 – with retailers selling homewares and fashion also having lots of bricks-and-mortar stores.

COLLECT FROM STORE

Click and collect is a useful way for retailers to attract customers into store. Some of those customers go on to make additional purchases while collecting their online order. At the least, they can see the physical products that the retailer sells and may go on to buy again in the future. Either way, click and collect offers convenience to customers and is a service that mobile shoppers in particular like to utilise.

However, in comparison to the number of retailers that operate stores, the number that enable customers to collect their online orders in store is relatively small. Just 126 of the Global Elite do so. The average retailer offers collection from 1,490 points including their own stores and third-party locations. Marketplaces offer the highest number of collection points, with the average being 2,370. Fashion retailers and brands are also keen to offer this convenience to their customers and understand how having a large number of pick up locations increases the convenience factor for customers since they are more likely to pass one of the locations during their normal daily routine.

Retailers in Europe, including the UK and Switzerland, offer the greatest number of collection points. The average is 1,850 while the median is 68.5. Within the region, retailers in the UK, Benelux and Nordics offer the most collection locations.

A smaller number of retailers own their own banks of collection lockers. The group that does so remains unchanged since last year, with just 1% of the 390 retailers measured in both years doing so. It is retailers in Croatia (6%), Czechia (5%), Sweden (4%) and Slovenia (4%) that are more likely to own their own collection lockers rather than depending on carrier-owned services.

FREE DELIVERY

One of the factors that consumers look for when shopping online is the cost of delivery. While less than a fifth of retailers offered free delivery on all orders in 2022 this has fallen two percentage points to just 17% of the Global Elite 1000 in 2023. It is more common for retailers to add a delivery charge on every order. A growing number of retailers (39% of the Global Elite) offer free delivery on orders above a minimum value threshold. In certain cases this will entice customers to add additional items to their basket before checking out or, at least, cover part if not all of the retailer’s cost of fulfilling the order.

Retailers headquartered in Spain are the most likely to offer free delivery on all orders. 23% do so. The percentage in Italy, Switzerland and Belgium is very similar (22% in each country). Spanish retailers are also among those most likely to give free delivery to customers once their order value has reached a certain minimum amount. This is the case with almost half (46%) of the retailers headquartered in this European country.

The figure is even higher in Australia where the majority of retailers (51%) offer free delivery once customer spend reaches a certain level.

HOW GLOBAL RETAILERS HANDLE RETURNS

Returns is another area that retailers need to manage carefully, both internally once products are returned so that they can be put back on sale as quickly as possible and also from a customer experience point-of-view. Two metrics measured by the RetailX research team give insight into this area. One is the number of retailers accepting returns by post – the most common method – and the other is the level of companies offering to collect unwanted items from the customer’s home.

Recently, retailers have begun charging customers for product returns in order to reduce the level of returns but also to cover some of their costs. For example, fashion brand Zara started charging customers for product returns in May 2022. In the UK, a charge of £1.95 is made for shoppers returning unwanted goods via a third-party delivery point. However, there is no fee for shoppers returning goods to stores.

Returns rates for Zara and other retailers rose in step with the shift to online, raising the potential costs of ecommerce. In March 2022, Boohoo said that it had seen a spike in returns as customers returned more unwanted online orders over the three months to the end of February.

Overall, the number of Global Elite retailers accepting returns by post has reduced by six percentage points, down to 74% from 80% in 2022. In Europe, this figure is just 69%, having fallen by ten percentage points since last year. The figures vary across different countries and among retailers selling different types of products. 86% of retailers in Slovenia and Romania accept returns via post, while 72% of those in the Middle East do.

RETAILERS COLLECTING RETURNS

The number of retailers that will collect product returns from a customer’s house remains the same as in 2022 at 11% but this metric it has varied between regions and types of retailers since that time. While still only offered by a small number of retailers, at least a fifth in Romania, Slovakia and Switzerland will make a collection from a customer. In Portugal, the number is closer to a quarter of the Global Elite headquartered in the country.

Conversely, only 5% of retailers in the UK, which has a larger percentage of Global Elite retailers and a more mature omnichannel market offer this service.

Across categories, it is mainly retailers that are likely to sell large items that are not easy for customers to post or return to a store that will collect unwanted or faulty items. Of these, retailers of DIY & trade products are the most likely to do so, with a quarter offering this service. Homewares, supermarkets, marketplaces and multi-sector stores all rank in the leading categories for this service.

This article was authored by Emma Herrod and originally appeared in the RetailX Global Elite Top1000 2023, which can be downloaded here