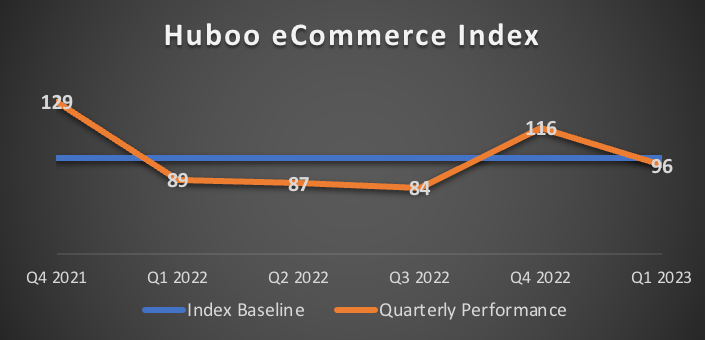

UK ecommerce industry sales performance is yet to fully recover from the macroeconomic challenges of the past year, despite the fact that trading over the first three months of 2023 increased compared to the same period in 2022, a new index has shown.

Huboo, an ecommerce fulfilment provider, has released its inaugural ecommerce Index to show that the UK ecommerce market is yet to recover from a turbulent 12 months of trading disruption caused by the ongoing cost-of-living crisis, supply chain shortages and the post-Covid return of high street retail.

According to the data, the Index is currently 4 basis points below the ecommerce industry sales performance baseline set at the end of Q3 2021, although YoY sales performance is 7.4 basis points higher than in Q1 2022.

Quarterly performance for Q1 2023 was down 17% compared to Q4 2022. While the ecommerce industry normally experiences a significant seasonal uplift in the final quarter of each year, Q4 2022 performance was itself significantly lower YoY, as ecommerce brands struggled to maintain sales volumes in the run-up to Christmas.

The Huboo ecommerce Index is a composite index of the performance of 275 ecommerce businesses by revenue, compiled across a broad range of categories to accurately reflect the performance of the ecommerce industry at large.

Huboo said unlike other measures of ongoing ecommerce performance, its index focuses on start-up to growth-stage companies – ambitious fast-growth retail brands who trade predominantly online, and whose fortunes will be instrumental to the fortunes of the wider market.

Paul Dodd, chief innovation officer at Huboo, said: “After the stellar growth experienced across eCommerce during the pandemic, it was always likely that 2022 would bring the market back down to earth. However, the tough conditions we’ve seen over the past 12 months have made sales growth challenging for even agile and forward-thinking brands.

“Our ecommerce Index is designed to monitor the performance of these high-potential brands. And while it’s been a difficult period, brands have now had time to reset their business models after Covid. Based on the feedback we’re hearing, they are starting to believe that an eCommerce bounceback is on the cards, particularly as social commerce continues to gain momentum.”

While market conditions remain challenging, Huboo’s quarterly ecommerce sentiment study suggested that optimism is returning to ecommerce.

The study reveals that two-thirds (67%) of ecommerce brands felt the cost of living was their biggest business challenge during Q1 2023, with 55% citing the challenge of keeping prices competitive.

And although half (48%) of respondents expect trading in 2023 to be stable, four out of 10 (38%) expect it to be successful and a further 70% are optimistic that sales will increase over the next quarter, with just 5% pessimistic about their sales prospects.

Brands are also intending to invest in their businesses over the next quarter, with well over half of respondents (58%) planning to increase marketing spend, 51% investing in product line enhancement/expansion and nearly a third (28%) into fulfilment.