Each year we – DeliveryX, Internet Retail and RetailX – produce a series of research reports reviewing and ranking the best retailers across the UK, Europe, and beyond. As 2022 draws to a close, we have collated some of the key findings from the DeliveryX Europe Top500, RetailX Sustainability Report 2022, RetailX UK Growth 2000 2022 and DeliveryX UK Top500.

In this roundup, the selected charts and figures aim to provide a picture of ecommerce delivery, operations and logistics over the past 12 months.

Customer expectations

The DeliveryX Europe Top500 Report found although delivery remains the preferred fulfilment method, the pandemic has seen retailers dropping next-day services.

Consumers are not expected to return to pre-pandemic buying behaviour and much of the online purchasing will continue, albeit with revised consumer expectations.

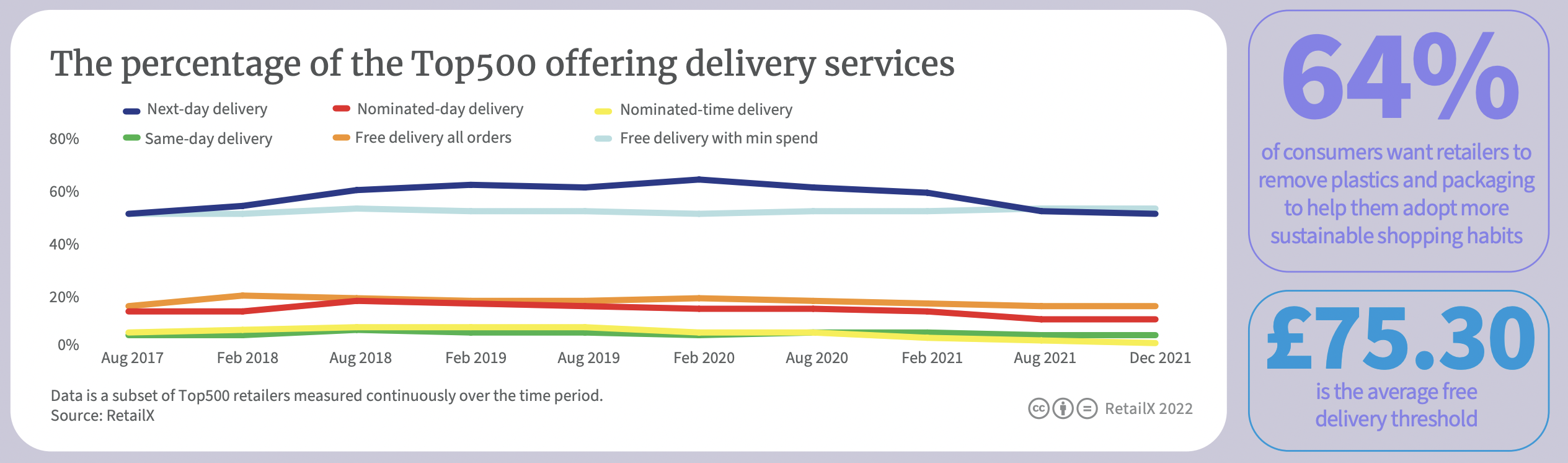

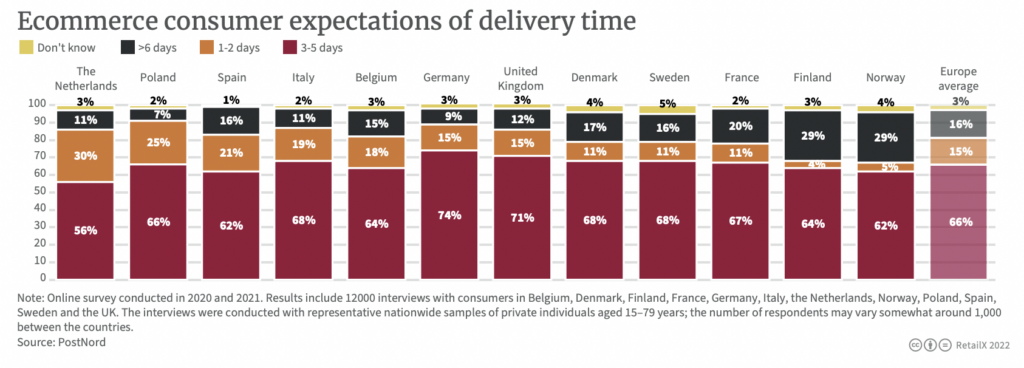

Choice of how and when an online order is delivered or collected is still a vital part of the ecommerce experience – as is the cost to the consumer – and these expectations vary between countries. Delivery is still preferred over collection, with most customers expecting to wait for three to five days for their online order to arrive.

What has changed are the nuances of those services. The number of retailers offering next-day delivery has decreased by 8 percentage points since February 2020. Just 38% of the EU Top500 retailers measured by RetailX in both February 2020 and March 2022 now offer it. Services such as nominated-day and nominated-time delivery remain constant but are still only offered by a select few.

Sustainability

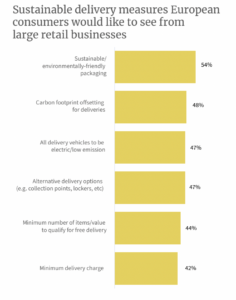

As well as preferring delivery over collection services, consumers increasingly expect retailers to be conscious of the environment and to reduce the impact of their products.

It is therefore not surprising that carriers and retailers are switching to electric vehicles and delivery methods with less impact on the environment. Evri, which says it aims to become the UK’s most sustainable delivery business, has been trialling a variety of options in different locations to explore how they affect delivery efficiency as well as congestion and carbon emissions.

Early data from a trial in Bristol with Zedify – which is testing pedal-powered electric vehicles such as cargo bikes – shows a 13% increase in efficiency plus a 98% reduction in carbon emissions when parcels are delivered by bike rather than by a traditional van.

Cargo bikes are not just a UK phenomenon. Dutch courier network Bringly is expanding its sustainable same day delivery network in Germany. The company is connecting urban cycle couriers through its software to deliver parcels from stores and hubs in ten German cities.

In the Netherlands, Sweden, Italy and France, H&M is enabling its customers to receive or return items using a bicycle delivery service, while customers in Sweden, Norway and parts of Germany can have their order delivered to climate-controlled smart lockers.

The desire for sustainability also extends to what goods arrive in. Conscious consumers making environmentally-friendly buying decisions are also looking for the packaging it arrives in to be green. The DeliveryX UK Top 500 Report found 50% of consumers want environmentally friendly packaging.

And the RetailX Growth 2000 2022 Report highlighted a few retailers that are responding to this consumer change. Revolution Beauty, Bloom & Wild, Vero Moda, The Whisky Exchange and Lovehoney have all made steps to improve their packaging.

Returns

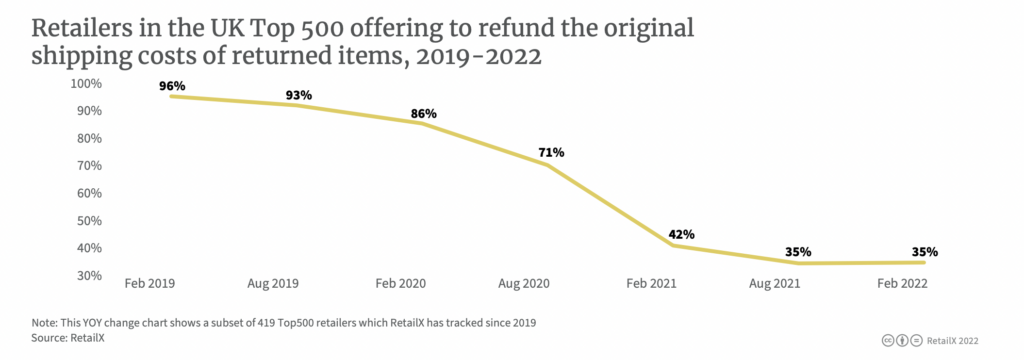

Getting products to consumers quickly and safely is always going to be high on the agenda for retailers in the ecommerce space, one of the biggest changes in 2022 was how these retailers dealt with returns. Zara set a precedent in May when it announced it would begin charging for ecommerce returns, in-store take backs would remain free. A host of retailers followed suit, with Asos even citing high return numbers for its drop in profits.

Furthermore, the DeliveryX UK Top 500 tracked the drop in retailers offering to refund the delivery charge. While, returns may have been a headache for retailers for some time, this year many started to put strategies in place to deal with the financial hit returns can cause.

Unsurprisingly fashion retailers, which as a sector have very high returns rates, are among the least likely to refund customers for delivery. Among the fashion retailers in the Top500, only 34% of the 199 retailers do so.

It will be interesting to see if more retailers follow Zara, Next, Boohoo and Asos in the charging of returns, and what 2023 will bring for the ecommerce sector as a whole.