The newly published RetailX Top1000 Europe report has highlighted that retailers across Europe have to achieve a balance between offering the delivery services that customers will use while doing so at a profit.

The report, which looks at how these retailers are innovating and improving the service that they offer, has found a small proportion offer free delivery on all orders (16%, unchanged on last year). Doing so helps these businesses sell higher volumes of products but this can also reduce profit margins.

It therefore makes most sense to offer free delivery on small, high-value products. This approach is most often used by Top1000 jewellers (42% of 794 assessed on this metric this year and last), and by websites selling musical instruments (29%) and software (28%), and when selling to Belgium (21%), Italy (20%) and the Netherlands (19%). It is likely to be offered when selling to Iceland (5%), probably because few retailers are based in that market.

A more popular option is offering free delivery when shoppers spend a minimum amount – an approach taken by 46% of retailers (unchanged on last year). This approach is more likely to be profitable, and so contribute to margins, but it may dent the volume of sales made. It is most commonly used by retailers selling stationery (67%), maternity and children’s products (65%) and sports and leisure or hobby equipment (both 64%), and when selling to Greece and Ireland (51%), Slovenia and Spain (49%).

Delivery times

Speedy standard delivery times can help to boost the volume of sales. The average Top1000 retailer offers delivery in 5.77 days and the median retailer 5.0 days. Supermarkets tend to deliver more quickly, taking an average of 4.4 days, and a median of 3.0, closely followed by specialist grocers (5.6/2.6). Shoppers ordering from Denmark (5.4/4.3) and the Netherlands (5.5/4.0) can expect the fastest standard delivery times, while those ordering from Iceland will wait the longest (12.3/8.5).

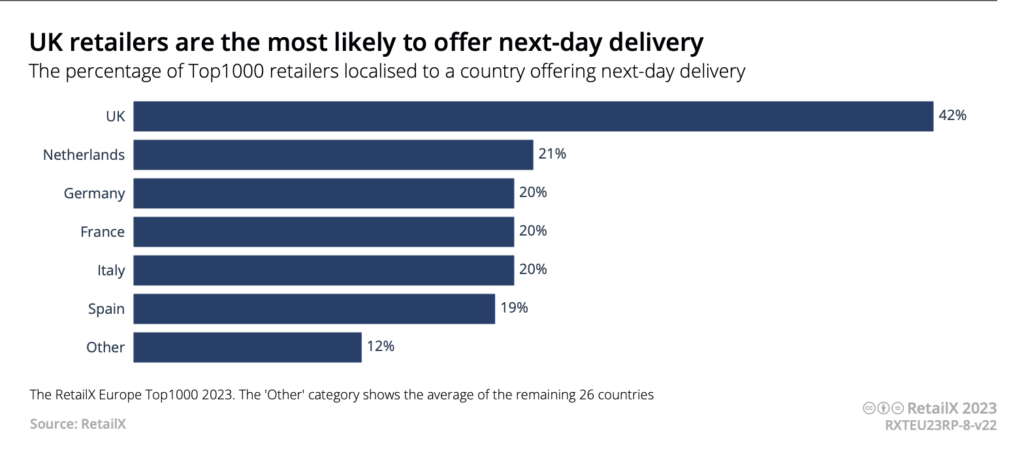

Faster delivery times have become slightly more available over the year, with next-day delivery now available from 30% (+2pp) and same-day delivery from 5% (+1pp) of 912 retailers assessed on this metric this year and last.

Both services are most likely to be offered by specialist grocers – 51% offer next-day delivery and 16% have a same-day service, as do 15% of supermarkets. Next-day delivery is also commonly found when buying from stationery (45%) and cosmetics (42%) retailers and brands. (See the graphics for uptake of both services in different markets.)

Saturday delivery (+2pp to 12%) is more widely found than Sunday delivery (unchanged at 5%).

What collection services do retailers offer?

When retailers offer collection, they protect their sales volumes and margins by removing the cost of delivery. This cuts lost opportunities since the service might win shoppers who would otherwise buy elsewhere. 46% offer collection in 2023, a rate up by 6pp on last year and a service most commonly offered by pharmacies (67%), hobby retailers (58%) and those selling automotive supplies and books (both 56%).

Collection is most often available from Top1000 retailers and brands selling to the UK (55%), followed by Luxembourg (46%) and Romania (42%), while there’s been a big rise in availability in Iceland (+10pp to 18%).

There’s been fast growth (+5pp to 6%) –albeit to a still low level – in the number of retailers that have their own collection lockers instore. Pharmacies are most likely to have them (39%), followed by booksellers (21%) and multi-sector retailers (11%). Retailers selling to Poland have adopted these quickly over the last year (21%, +14pp), while they are also relatively popular in Czechia (13%), Sweden (12%) and Finland (10%).

The average collection order is ready to pick up in an average of 71.7 hours (just under three days) and a median of 60, both unchanged on last year.

The fastest collection times are from DIY and trade retailers – where they are available to pick up in an average 1.4 days and a median of 1.1 days –and from supermarkets, in an average of 2.2 days and a median of 1.0 day. The fastest average collection times are to the Netherlands (2.35 days/2.0).

Next-day collection is available from 14% (-1pp) of retailers, while 9% (-1pp) offer same-day pick-up. Next-day collection is most commonly available from specialist grocers (46%) and supermarkets (27%) and when buying in the UK (16%, -1pp) and Norway (15%). Same-day is most available from DIY and trade retailers (22%), from musical instrument retailers and brands (19%) and when buying from Sweden (11%), Switzerland and France (both 9%).

The median retailer does not charge shoppers to collect an item, down from €1 last year. Where retailers charge, the average cost of collection has fallen by €0.52 to €1.88 over the last year.

Supermarkets (average €1.24/median €0.89) and maternity and children’s businesses (€1.81/€1.45) tend to charge the least, as do those selling to customers in Hungary (€0.36/0) and Lithuania (€0.68/0). Those selling in Romania (€3.17/0) and Denmark (€2.85/€2.35) charge the most.

This feature originally appeared in the RetailX Top1000 Europe report. Download this comprehensive annual report in full. It also includes seven company profiles illustrating how the top retailers and brands are leading the way: Albert Heijn, H&M, Empik, Oysho, Castorama, GuitarGuitar and River Island. And an exclusive interview with Ikea.