The first edition of the RetailX United States Growth 2000, which takes a new perspective on one the world’s largest and most exciting ecommerce markets, found retailers that stand out in the Delivery Dimension stick to their promises.

Delivery is the fourth Dimension of Growth 2000 research, since providing a fast and convenient delivery service is key to growing retail sales effectively. How quickly a product will arrive is also an important factor when shoppers make buying decisions.

RetailX Consumer Observatory research in the US market suggests that delivery options are important for 50% for respondents. 78.6% say it’s important or very important that online retailers provide next-day delivery, while 73.2% say the same for same-day delivery – and 60.5% for carbon-neutral home delivery. A collection option, meanwhile, is important or very important for 58%.

RetailX research found that while lower prices are the most important factor when shoppers decide to switch to a new product, better delivery options come in second place. That said, when shoppers were asked what type of discount they preferred when shopping, free or reduced shipping costs were most often named.

So how do US Growth 2000 retailers and brands measure up to those expectations? RetailX researchers considered the service that US Growth 2000 retailers offer to shoppers, analysing their performance through two key questions: what fulfilment promises do Growth 2000 retailers make? How well do Growth 2000 retailers keep shoppers informed?

What fulfilment promises do Growth 2000 retailers make?

The speed and convenience of delivery promises are most easily measured through whether they offer faster services and collection, and their attitude to accepting returns of item bought online.

fastest delivery

Next-day delivery

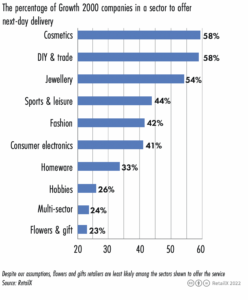

Next-day delivery is commonly offered – 47.5% of retailers have it as an option. It is available more often from retailers and brands selling cosmetics (58%) and jewellery (54%), while those selling sports and leisure clothing and equipment (44%), fashion (42%), consumer electronics (41%), homewares (33%)

hobbies (26%) and multi-sector retailers (24%) all do so at a lower rate.

Same-day delivery

Same-day delivery is offered by a small minority of retailers and brands, with 2.7% of 1,533 assessed on the metric offering the service. Retailers selling homewares (8.3%), multisector (8.1%) and cosmetics retailers offer this at an above average rate. But retailers and brands selling jewellery and hobby supplies (both less than 1%), fashion (1.1%), consumer electronics (1.5%) and sports and leisure retailers (1.8%) all offer the service at a lower rate.

Collection

Only 198 (11%) of 1,820 retailers assessed on this metric offer click and collect services. Shoppers buying from that small group can expect to be able to pick up their orders in an average of 134 hours (five days and 14 hours), while the median time from order to collection is 120 hours (five days).

Returns

There’s no legal requirement under federal for US retailers to enable shoppers to return an unwanted item for a refund, although there is a cooling off rule that gives shoppers three days to change their mind about a purchase worth $25 or more.

Retailers only have to accept returns if the goods are faulty or break the sales contract in another way, according to FindLaw.com[1]. At state level, there is a variety of rules. In California, for example, retailers have to post their refund policy unless they offer a full cash refund, exchange or store credit within seven days of purchase. However, those that do not meet that requirement must accept full returns within 30 days of buying.

That said, RetailX research finds most Growth2000 retailers do offer returns of unwanted items bought online, perhaps because offering the option makes it more likely that shoppers will buy. 1,503, or 82%, of the 1,820 Growth 2000 retailers assessed on this metric enable customers to return an item they bought

online for any reason within a given time frame. Buyers have an average of 45 days and a median of 30 days to make a return.

How well do Growth 2000 retailers keep shoppers informed?

Informing shoppers about their buying options – from whether items are in stock to how quickly they can be delivered – can both help to ensure that they continue their shopping journey on the website and that their expectations aren’t disappointed at the checkout.

Showing fulfilment options on the landing page 68% of consumer electronics retailers take the approach of showing their fulfilment options on the landing page so that shoppers have an idea of how quickly they can expect to receive their goods before they get to the product page or checkout.

Stock visibility

Showing whether an item is in stock can help shoppers to know whether it’s worth proceeding to buy it, whether it’s in stock online or instore. RetailX analysis suggests that multichannel consumer electronics retailers (42%) are most likely to show via their websites whether stock is available online, followed by brands (25%) and fashion retailers (18%).

Multichannel fashion retailers are most likely to show on their websites whether stock is available instore, with just under a third (31%) doing so. Almost a quarter of brands (23%) show instore stock, while less than 1% of consumer electronics websites do so.

This feature originally appeared in the 2022: United States Growth 2000 report.